The challenge. The problem of measuring non-quantitative aspects has always troubled us. A dish that I would consider good, for you it could be just decent, as it could be for an experience in a Shopping Center or in a store.

How can we evaluate the quality of the customer experience? How can we know if our customers are really satisfied? How can we communicate our results to others or how can we make comparisons with the past if we have no objective parameters?

There are many tools for this purpose, each with pros and cons.

The customer’s perception is your reality.

[Kate Zabriskie]

Surveys and questionnaires. Among the tools to evaluate the level of satisfaction, we find the surveys and questionnaires, with which the client is asked to give voice, in anonymous form, to his own opinions.

In the questionnaires the overall purchase experience is typically broken down into various topics, each analyzed with one or more questions: staff competence, product availability, quality over price ratio, …

The open questions, which are difficult to be analyzed, have been progressively replaced by questionnaires in which it is possible to express the level of satisfaction on pre-established scales or where it is possible to choose one or more of the options provided.

In summary, we do everything possible in order to make objective what objective cannot be: the individual perception.

With the questionnaires we go to ask the customer himself what he thinks. Very well! The problem is that it is not possible to interview all of them, due to temporal and economic constraints. So, as it is often the case, it is necessary to select a part of them and hypothesize that the selected ones represent the customers in their entirety: we try to have a sufficiently large sample, which is representative of the entire population.

Anyway, who ensures us that the customer says what he really thinks? Were the interviews conducted correctly or were they somehow manipulated? And did those who refused to submit to the survey – because there are always some – have changed the original representativeness of the sample?

The possible sources of compromise of the collected information are many and sometimes they are found in unexpected “places”. For example, researches show that changing the order of questions in a survey can lead to different answers, as it leads the interviewee to follow a specific mental path rather than another. The place, the time of day and the method of somministration (face to face, by phone or by e-mail) can also affect the results.

The non-objectivity of the answers could easily be tested by asking some people what response they provided to a given question, a few hours after being polled. Surprisingly, the percentage of those who answer correctly about their own answer is not 100%. Who answered with a grade 7 on a scale from 1 to 10, is not so rare that he says he indicated 6 or 8. It is not only lack of memory, it is also poor objectivity of the quantification of a qualitative perception, which depends on by different factors that cannot be severely separated from each other.

We can strive as much as possible, but this source of alteration will never be totally eliminated, as it is inherent to our perception of human beings. Yet, if we work with sufficiently large numbers and with the appropriate modalities, the data obtained from questionnaires produce significant information, which can be translated into effective actions.

Mystery shopping. Let’s try to analyze another tool: the mystery shoppers. These figures are “fake customers” who, as spies, evaluate the quality of a certain commercial reality. Mystery clients are specially trained to objectively judge a series of parameters: environment, staff courtesy and availability, product display, compliance with procedures, …

However, even here we have some problems:

mistery shoppers are human beings and therefore their objectivity is limited;

they may not be so motivated to perform well their task, because it could be only an occasional job;

they are not true customers;

their satisfaction was somehow manipulated by those who assigned the task;

it is a very expensive technique.

Trust the (right) data. Well, what’s left? Let’s take a look at the data in our possession. We could analyze sales and their trend. We could think that, if they go up, it will mean that customers are more inclined to buy, so their experience is quality. And viceversa.

Yet, the amount of sales and the buying experience of customers do not always correlate positively: it is not certain that, as the quality of the experience increases, there is an increase also in sales.

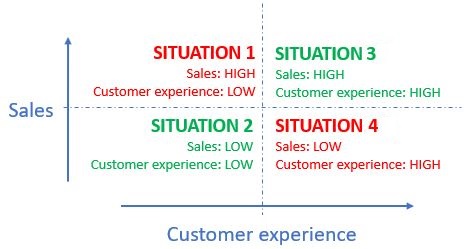

In fact, it could happen that the customer’s experience is positive but the sales are low and viceversa. The possible situations are summarized in the following graph.

If the scenarios in green are intuitive, we cannot say the same for those in red, which are in any case possible. To understand the latters, the sales data are not enough: we need the footfall and so the people counter.

If there is a large amount of people, the customer experience could get worse as the salespeople are overworked and fail to respond to all the requests by potential customers. Overall sales could still be high, simply due to the large number of people involved (situation 1).

If there is little traffic, the experience could improve because the salespeople are immediately available and have more time to dedicate to each customer, but this may not generate an increase in sales: we could have a higher percentage of buying people, but they are anyway few because this increase in the percentage of buyers on the total prospects can be translated into an increase in sales (situation 4).

So the answer lies in the conversion rate, which is the percentage of people who become customers over the total number of prospects.

In general, sales are function of footfall, conversion rate and average receipt amount, but customer experience does not correlate directly with sales. The correlation between conversion rate and customer experience is undoubtedly greater: the more the experience is good and the greater the conversion rate; if instead the buying experience worsens, then the conversion rate will also be affected.

In summary, from the conjoint analysis of traffic and conversion rate it can be seen whether the purchase experience worsens because of a lack of staff, in number or in sales performance. If so, this awareness can be translated into a concrete data-driven action: changing staff shifts.

The winner is team play. But can we blindly trust the data? Can we make general and secure conclusions only by reading the data? Who tells us that, in the situation in which there seems to be a shortage of staff, the buying experience is not worsened by the fact that the available cash desks are few and therefore an excessively long queue make people going out without purchasing? If this were the real cause, a change in staff shifts would be completely useless.

According to Microlog the best strategy is to be guided by the data and then to deepen the selected situations with other techniques: the data could point out the situations that would be better to investigate and then, with surveys and/or mystery shoppers, a more detailed analysis could be performed.

Installing the people counter allows you to understand where and when to investigate, in order to see if and how it is possible to improve your sales performance. Thanks to the people counting it is therefore possible to use mystery clients and/or questionnaires only when necessary, because they are very useful but expensive.

Your most unhappy customers are your greatest source of learning.

[Bill Gates]

Everything is very open with a precise clarification of the

challenges. It was truly informative. Your website is very useful.

Thanks for sharing!

Thank you for your words, we appreciate!?